Payment License

- Companies contemplating about starting a business related to the provision of payment services are mandated to have the requisite authorization in the form of a payment license in the proposed jurisdiction.

- However, when talking to different people about what license is required for providing payment services, you will get a multitude of different answers. Some will tell you that an e-money license is what you need. Others may mention that a “payment institution license” is entirely sufficient. There may also be other opinions that you need to be a bank for everything to work.

- Tetra Consultants helps you navigate this jungle and will guide you on what types of licenses are there for payment services, what type of license you need according to your business model. Moreover, we provide a wide array of services to our international clients from the formation of the business entity to ultimately getting a payment license for its operation.

What is a payment license?

- A standard payment license is an authorization for the holder to provide services related to the payment systems. A typical payment license allows the financial institution to provide services such as money remittance, account issuance, and e-money issuance services.

What are the types of payment licenses?

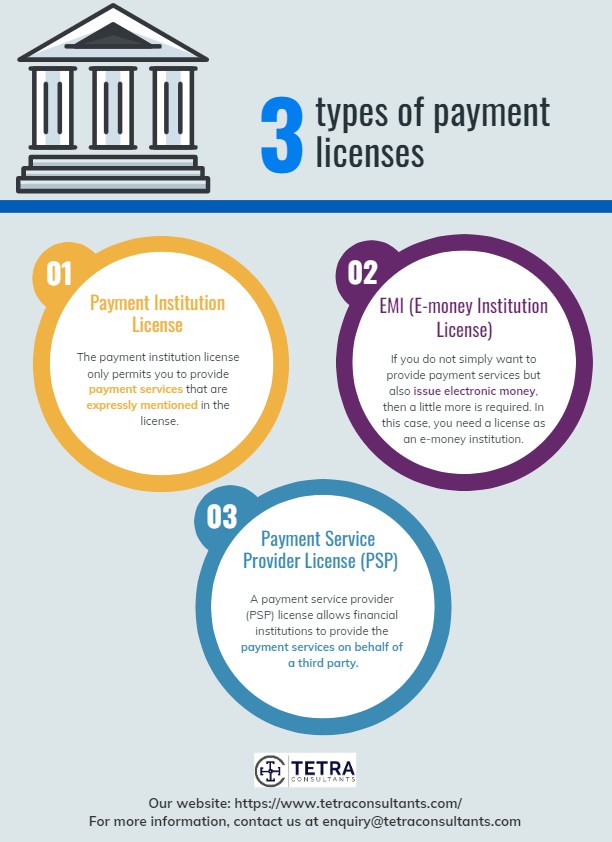

- Depending on your business goals and objective there are different types of payment licenses available as mentioned below:Payment Institution License

- The payment institution license only permits you to provide payment services that are expressly mentioned in the license. If, for example, you only have a license for payment initiation services but you also want to provide account information services in the future, you need to apply for an additional license.

- The payment institution license or registration is also known by other names. Some call it the “PI license” where “PI” is short for “payment institutions”.

- Payment institution licenses are issued in different jurisdictions under different names. For example in Singapore, there are two types of payment institution licenses – Standard Payment Institution License and Major Payment Institution License.

- For example in the United Kingdom, there are Small Payment institutions (SPI) and Authorized Payment Institutions (API).

EMI (E-money institution license)

- If you do not simply want to provide payment services but also issue electronic money, then a little more is required. In this case, you need a license as an e-money institution. A license as an e-money institution not only allows you to issue e-money but also to provide all payment services.

- In other words, an e-money institution may automatically provide all types of payment services. The license as an e-money institution is also sometimes known as an “e-money license” or an “EMI license”.

- E-money licenses of different jurisdictions will have different characteristics to offer. Some of the more popular e-money licenses include the Poland EMI license, Lithuania EMI license, and Latvia EMI license.

- All these licenses allow financial institutions to store monetary value electronically and can be represented by a claim on the issuer. This can be retrieved by the electronic money holder to make payments, additionally, it can be used to pay for goods and services sold by a natural or legal person who is not the electronic money issuer.

Payment Service Provider License (PSP)

- A payment service provider (PSP) license allows financial institutions to provide the payment services on behalf of a third party, under the regulation of the proposed jurisdiction.

- The kind of services that a payment service provider license allows you to conduct can include the taking of deposits from the third party, transferring money on behalf of the third party, offering such other services like the security of financial data, transactional reporting, currency processing for cross border transactions under different currencies.

- Therefore, a typical payment service provider license will enable you to act as a mediator between the clients, merchants, and financial institutions for the settlement of funds from the client’s account to the merchant’s account. In some jurisdictions, PSPs are also known as payment processors and merchant service providers.

- A payment service provider license can be termed differently in different jurisdictions. For example, In New Zealand, a payment service provider is mostly referred to as the New Zealand Financial Service Provider License (FSP) regulated by the Ministry of Economic Development.

Who is the issuing authority of a payment license?

- A payment license is issued by the central banking authority of the proposed jurisdiction under the legislation so enacted to regulate such entities.

- For example, In Lithuania, the Bank of Lithuania which is the financial service regulator administers and issues Lithuania EMI licenses as empowered under the regulating statute. One of BOL’s functions is to ensure the security and soundness of all payment, clearing, and settlement systems. All e-market institutions with a Lithuania EMI license are governed by the provisions in the Republic of Lithuania Law on Electronic Money and Electronic Money Institutions.

Why do we need a payment license?

- Depending on the range of authorization granted by the regulatory authority, a general payment license will enable you to provide services where funds can be transferred and recovered into a payment account for operational purposes, carry on a payment transaction from one payment account to another, and process direct debits including one-time direct debits.

- Additionally, it will also allow you to complete payment transactions using credit cards and other similar devices, credit transfers, and a payment transaction for the user where the funds are backed by a credit line.

- In addition, it enables license holders to provide services of initiating payment and account information, issuing e-money, provision operational services, and closely related ancillary services, and operate such other payment systems, and provide such other additional sets of services to operate a payment account.

What are the positive implications of obtaining an offshore payment license?

- Payment service providers situated in major financial centers encounter near-unsustainable levels of governmental scrutiny and criticism. As a result, payment services have become significantly constrained in the industries they operate, shunning not only conventional high-risk areas but also more traditional, conservative business regions.

- An offshore payment license, among other things, provides a reputable framework for operating a payments-related company free of the constraints that operators in larger jurisdictions face.

For example, if you set up a licensed payment service provider entity in the Bahamas, you will have the benefit as:

- No corporate tax

- Payment institutions enjoy less stringent regulatory

- Advantageous tax treatment for shareholders of PSPs

- A stable political environment

- A cost-effective jurisdiction

What are the regulatory requirements and documents for obtaining a payment license?

For obtaining a payment license, the international regulator will most likely ask you for the following things-

Minimum capital requirement

- The first and foremost point of consideration is to have met the specified minimum capital requirement by the regulator. Additionally, for payment licenses, a regulator may also ask for a combination of base capital, risk-based capital, and expense-based capital.

- For example, the Dubai Financial Service Authority (DFSA) requires a Dubai International Financial Centre based PSP to provide for the aforementioned combination of capital requirements wherein base capital can be US$500,000 for PSPs that issue stored value while the requirement of base capital is US$200,000 for PSPs that does not issue stored value.

- Similarly, in the Bahamas, the Central Bank of The Bahamas requires an entity to have a minimum capital requirement of US$100,000 to obtain the payment service provider license.

- Accordingly, the Monetary Authority of Singapore (MAS), requires a Singapore standard payment institution to have minimum paid-up capital of S$100,000 and Singapore major payment institution to have minimum paid-up capital of S$250,000 for obtaining the respective licenses.

- On the other hand, for a Lithuania EMI license, the entity is required to meet the minimum capital requirement of EUR 350,000.

Ownership of share capital

- For a payment license, a regulatory authority may not allow having full ownership of the business. Therefore, in some jurisdictions, a wholly-owned foreign company may not be allowed to operate especially for the businesses having the payment risk.

- For example, in Ghana, there should be a minimum of 30% of the ownership of share capital in the favor of Ghanaians.

Number of Directors

- For most of the payment licenses, the regulator would ask you to meet the requirement of having the specified number of directors and even if there is no requirement of having a specific number of directors, these must meet certain eligibility criteria, among which they must be of good character, have the necessary experience to manage and complete their daily activities, as well as meet the reporting requirements imposed by the law.

- For example, in Lithuania, companies applying for EMI licenses must meet the requirement of having at least 1 director who should be resident in Lithuania.

Required Documents

To get a payment license, the international regulator will most likely ask you to provide the following set of documents:

- A program of operations that envisages the payment services to be provided;

- A business plan which includes a forecast budget calculation for the first three financial years and which shows that the applicant can employ such systems, resources, and procedures to operate the business soundly;

- Proof that your entity has the required initial capital as mandated under the law;

- A description of the measures to safeguard the funds of payment services users;

- A description of your entity’s administration and internal control measures, including administrative, risk management, and accounting procedures, indicates that these security and management methods are acceptable and adequate;

- A statement of the internal control systems created by the entity to meet the standards of the Prevention and Suppression of Money Laundering Activities Law

- An overview of the entity’s engagement in a national or international payment system, as well as its structural organization, including, if relevant, a description of the anticipated outsourcing arrangements and/or usage of agents and branches;

- The name of individuals who have direct or indirect control of the applicant or who are partners in the partnership, as well as details on the number of their holdings and evidence of their competency in light of the requirement to maintain the entity’s competence and responsible management;

- A description of the business continuity arrangements;

- The informational data of all directors as well as of the persons responsible for the management of the payment services activities, evidence that they are of good repute and possess appropriate knowledge and experience to perform payment services, in particular a copy of a criminal record, a non-bankruptcy report, a description of professional and academic qualifications, of the positions of manager or director that they hold in other legal persons and of their previous employments;

- The identity data of statutory auditors;

- The legal documents like memorandum and articles of association, AML/CFT policies, and such other documents required under local law;

- The address of the registered head office;

- All the information about the process for filing, monitoring, tracking, and restricting access to sensitive payment data;

- The procedure for monitoring, handling, and following up on security incidents and security-related customer complaints;

- And, such other documents may be required.

What is the procedure for obtaining a payment license?

Different nations have different methods, regulations, and processes for setting up and applying for payment licenses. Tetra Consultants has compiled a list of the more prevalent processes involved in obtaining a payment license in a normal engagement.

Step 1: Choosing the best-suited jurisdiction and payment license

- In order to get a payment license, you must register the company in the jurisdiction whose terms and conditions are most suitable for your business goal. Tetra Consultants will advise on the most suitable jurisdiction and license for your business.

- Our team of experts will provide you with the requirements of the license including paid-up capital requirements, local economic substance requirements, timelines, and processes before the start of the engagement.

Step 2: Company registration

- Tetra Consultants will perform due diligence on the company’s directors and shareholders. We will commence registering the entity with the local Companies Registry after we have all KYC credentials, incorporation forms, and power of attorney.

- We will deliver the corporate documents, including the Certificate of Incorporation, Memorandum and Articles of Association, and other internal documents, after the entity has been officially incorporated.

Step 3: Opening a corporate bank account

- Tetra Consultants will proceed to open a corporate bank account with a reputable bank. This bank account will be used to deposit the minimum paid-up capital required to secure the license.

Step 4: Preparation of corporate & other documents

- The legal experts at Tetra Consultants will draft the necessary documentation for the licensing application. Depending on the local laws, these papers will contain the company strategy, AML/CFT policy, and other necessary documents.

- Tetra Consultants will deliver you the draft of such documents after they have been prepared. Following that, we will email them to you for e-signature and start working on your license application.

Step 5: Meeting local economic substance requirements

- Tetra Consultants will guide you in meeting the requirements of the local regulator if the economic substance is required. Our staff will aid in the hiring of qualified personnel from the local region.

- Tetra Consultants Human Resource Team will perform the applicant shortlisting and initial interview. After that, you may narrow down the final list of prospects to assess who is the best fit for the business. Tetra Consultants will assist with the preparation of a contract of employment with the agreed terms once the candidate has been recruited.

- In addition, our staff will compile a list of physical offices and deliver it to you. We will include crucial information like monthly rental, location, and size so you can determine which one is appropriate for you. Tetra Consultants will prepare a draft of the lease agreement for you and the landlord to sign after the office has been approved.

Step 6: License application filing and submission

- Tetra Consultants will submit to the local regulator once the aforementioned steps are concluded. Before receiving a license, you may be asked to attend an interview with the regulator, depending on the jurisdiction. Tetra Consultants will train you for the interview and support you with the necessary regulatory follow-up steps.

- If everything goes according to plan, your entity will receive the payment license and will be needed to begin commercial activities within the specified term to maintain the license.

How long does it take to obtain a payment license?

- Before the start of the engagement, Tetra Consultants will send you a project plan with the timelines stipulated for company registration, preparation of documents as well as license application. This is to ensure that all parties are clear on the upcoming project.

How much does it cost to obtain a payment license?

- The total engagement fee depends on the services you need from Tetra Consultants. We provide you with multiple services ranging from assisting you through the incorporation process to obtaining the payment license. This total fee that will be charged will be inclusive of the company registration fee, license fee, and any additional cost that may arise.

- We will discuss with you the total engagement fee charged in detail before we begin the registration process so that you have a better understanding of what you are paying for.

Our services

- If you are thinking of applying for the payment license it is always advisable for you to hire a consultant to help you with the application process. In practice, applications that have sought professional help are frequently more detailed and of far higher quality.

- Tetra Consultant is proficient in providing consulting services for obtaining offshore payment license financial licenses and provides a comprehensive set of services with regards to payment licenses which include preparing the application form, creating a comprehensive timeline for the full setup and operation of your entity, drafting the needed documents, gathering relevant and acceptable data.

- Moreover, Tetra Consultants also provide advisory services related to management structure, designing and creating a business plan that includes: – strategy/market/client target/customer journey, the structure of the company, procedures for operations, procedures for AML, communicating with regulatory authorities on behalf of the customer, serving as a liaison/Project Manager, tax Compliance and legal services.

- Tetra Consultants will assist you with communications with the local regulatory authorities, and government officials throughout the whole course of the engagement.

- In addition, Tetra Consultants can also assist with attaining other offshore financial licenses depending on your long-term business goals.

Find out more!

Contact us to find out more about how to get a payment license. Our team of experts will revert within the next 24 hours.

FAQ

How do I get a payment bank license?

- A payment bank license is a mandatory requirement to open a payment bank. Before applying for the license, the applicant needs to accumulate the required minimum paid-up capital first and then incorporate an entity conforming to the local laws of the proposed jurisdiction.

- Tetra Consultants is proficient in providing assistance to our international clients in obtaining payment licenses. We make sure that our clients get the approval and payment licenses in a shorter period of time while taking care of all the regulatory requirements and preparation of documents.

How do I get a payment service provider license?

- To get a payment service provider license you will first need to set up an entity in the best-suited jurisdiction according to your business goal and the licensing requirements under the respective regulatory authorities.

- Tetra Consultants helps clients all over the world from the formation of any type of entity to obtaining all types of offshore financial licenses.