Payment Institution License UK

- Tetra Consultants specializes in getting a payment institution license UK, which includes the preparation and filing of all documents necessary for authorization/registration, as well as legal consultation with UK business law and incorporation.

- Furthermore, our team of experts will assist in communications with FCA throughout the process to ensure that all queries posed by the regulator are addressed. Additionally, we provide assistance with the business plan, banking partners, suitable employees, and help you open a corporate bank account.

- If you want to offer regulated payment services like money transfer, payment processing/merchant acquisition, payment initiation, or account initiation, you must get a relevant UK payment license for operating as a payment institution.

- However, without the right expertise and market insights, the procedure of obtaining a payment institution license UK can be time-consuming. While you may be certain of the business model you desire, it may be unclear to you what type of payment licenses and permits are necessary from a regulatory standpoint. The following sections include important information and requirements for obtaining a Payment institution license UK.

- The following sections include important information and requirements for obtaining a Payment institution license UK.

What is a payment institution?

Payment institutions are companies established for the purpose of providing payment services as their core business activity. In conformity with Regulation 2(1) of the Payment Services Regulations, any of the following entity in UK can be regarded as a payment institution and may perform payment services under an authorized UK payment license:

- An authorized payment institution

- A small payment institution;

- EEA registered account information service provider,

- A credit institution;

- An electronic money issuer;

- The Post Office Limited;

- The Bank of England, the European Central Bank, and the national central banks of the EEA States other than the United Kingdom, other than when acting in their capacity as a monetary authority or carrying out other functions of a public nature and;

- Government departments and local authorities, other than when carrying out functions of a public nature.

What are the types of payment institution licenses in UK?

The legal and business jargon may vary but the most prevalent types of payment institutions in the UK can be as mentioned below:

Small Payment Institution License UK

There is an option to obtain a license of a Small Payment Institution (SPI) if you are comfortable with complying with certain restrictions, which are as follows:

- The projected average monthly payment transactions must not exceed EUR 3 million;

- No possibility to provide payment initiation service; and

- No possibility to provide account information services.

Small Payment Institutions can provide all the same services as Authorised Payment Institutions, excluding payment initiation services and account information services. To become a Small Payment Institution, a company has to be registered by the FCA.

Initial Capital Requirement for acquiring Small Payment Institution License

There are no initial capital requirements for SPIs unless they go above the limit as mentioned earlier. If a Small Payment Institution wants to go above the limits, it must pass a procedure of authorization and become an Authorised Payment Institution. In such a case, the initial capital requirements for APIs will apply.

Authorised Payment Institution License

An authorized Payment Institution (API) can be authorized to provide the full range of payment services enshrined in the Payment Services Regulation Act, 2017 without any restrictions or limits.

Initial Capital Requirement for acquiring Authorised Payment Institution License

For a company wishing to provide more than just money-remittance, account information service, and payment initiation service, there is a requirement to have initial capital amounting to EUR 125,000. Additionally, if the company is willing to provide payment initiation and/or account information services, professional indemnity insurance is required.

What is a payment institution license UK?

A Payment Institution License UK enables you to offer payment services to the UK market, including, payment accounts, payment processing, merchant acquiring, and money transfer services.

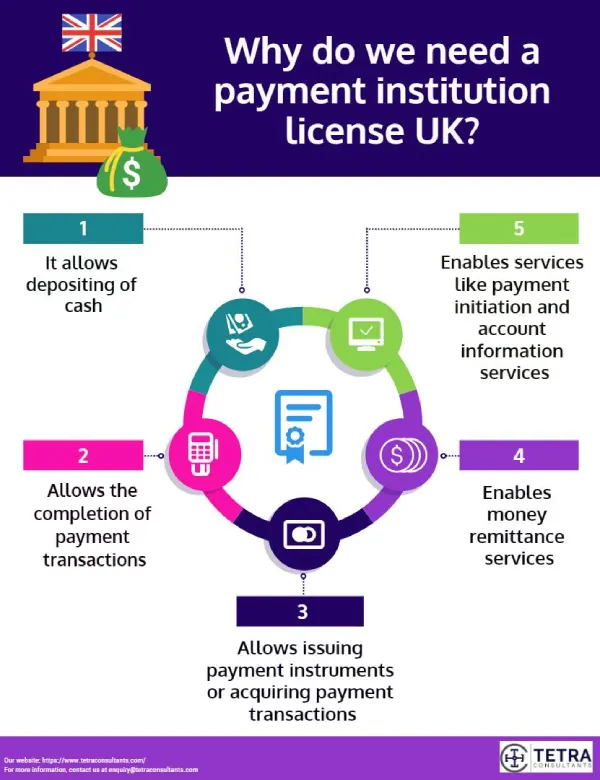

Why do we need a payment institution license UK?

According to Regulation 2(1) of the Payment Services Regulation Act, 2017, there is a total of eight core services that a Payment Institution (PI) can provide. Based on the Payment Institution License UK an entity can provide one or all of the following services:

- Services allowing cash to be deposited into a payment account and all of the operations necessary to run a payment account;

- Services allowing cash to be deposited into a payment account and all of the operations necessary to maintain a payment account;

- The completion of payment transactions, which include transfers of funds on a payment account with the user’s payment service provider or another payment service provider entailing the execution of direct debits, including one-time direct debits, the execution of payment transactions via a payment card or a similar device, the completion of credit transfers, including standing orders;

- The completion of payment transactions for a payment service user where the funds are covered by a credit line entailing the execution of direct debits, including one-time direct debits, execution of payment transactions via a payment card or a similar device, execution of credit transfers, including standing orders;

- Issuing payment instruments or acquiring payment transactions;

- Money remittance;

- Payment initiation services;

- Account information services

Furthermore, the payment institution license UK permits the conduct of operations that are supplementary to and closely connected to the payment services for which it is authorized, such as:

- Ensuring the execution of payment transactions;

- Foreign exchange services;

- Safe-keeping activities;

- The storage and processing of data;

- The operation of payment systems.

Who is the regulating authority of payment institutions in the UK?

The Financial Conduct Authority is the UK’s regulator for financial services, including, Payment Institutions, also known as Authorised Payment Institutions. The Financial Conduct Authority is the regulator for 59,000 financial services firms and financial markets in the UK.

What are the other laws governing a payment institution in the UK?

PSD2, or the Payment Service Directive 2, is an EU Directive (Directive 2015/2366) that sets requirements, including for UK Payment Institution, also known as the Authorised Payment Institution, and the API License.

The following regulations are also applicable for payment institutions:

- Revised Payment Services Directive (PSD2)

- Payment Accounts Directive

- Credit transfers and direct debits in euro (SEPA)

- The Payments in Euro (Credit Transfers and Direct Debits) Regulations 2012

- Data Protection Act 2018

- Guide to the UK General Data Protection Regulation (UK GDPR)

- Proceeds of Crime Act 2002 (POCA)

- Terrorism Act 2000

- Money Laundering, Terrorist Financing and Transfer of Funds 2017

- Regulation on interchange fees for card-based payment transactions (EU) 2015/751

- The Money Laundering and Terrorist Financing Regulations 2019

What is the difference between EMI and PI?

- There are two main types of financial institutions – Authorised Payment Institution (API) and E-money Institution (EMI). Before you apply for a license, you need to understand the difference between these institutions.

- The Difference between Authorised Payment Institutions (APIs) and Electronic Money Institutions (EMIs) is that E-Money Institutions, in addition to the list of Payment Services that an API may conduct, can also issue electronic money.

- The definitions of these institutions are developed under different directives. Payment institution service provision is defined under the PDS2 Directive (Directive 2015/2336/EU), while E-money institution services are defined by the EMI Directive (Directive 2009/110/EC ). However, both EMIs and PIs must comply with PSD2 standards.

What are the benefits of having a payment institution license UK?

The UK is regarded as one of the most important financial centers in the world. Such facts are unsurprising, given the many advantages of locating your payment FinTech business in the United Kingdom. Here is a list of reasons why you should apply for a payment institution license in the United Kingdom.

UK regulator FCA is one of the best

FCA has permitted more than 3500 firms to provide payment services under the payment service provider regulations which are more than all other EU regulators combined. The regulator has a lot of experience with applications, and the whole process of authorization/registration is quite fast compared to most other jurisdictions. Additionally, the FCA experts know a lot about fintech and understand how to regulate firms after permission to operate is granted.

Favorable tax regime

There is no withholding tax on dividends paid out by UK companies to any shareholders.

The UK`s fintech market overview:

Due to the obvious regulatory approach that encourages financial services innovation, the UK’s fintech market has been recognized as a European fintech center in recent years and will most probably stay a front-runner in the industry.

According to “The Global Fintech Index 2020,” the country is ranked second in the world for fintech.

What are the regulatory requirements for obtaining a payment institution license UK?

When setting up an entity for obtaining payment institution license UK, you will be required to adhere to certain regulatory requirements as mentioned below:

- The requirement to meet the initial minimum capital requirement of €20,000 to establish a Payment Institution.

- The requirement to safeguard client funds either with a segregated client bank account or with an insurance policy.

- The management body of the payment institution must be of good repute and possess the relevant qualifications and experience to perform their duties.

- The shareholders must be fit and proper.

Other conditions to be fulfilled as set out by FCA-

- You are a body corporate (eg a limited company or partnership)

- You must carry on – or will carry on – some of your payment services business in the UK

- You have robust governance arrangements and internal procedures and control mechanisms

- You have a business plan

- You have taken adequate measures to safeguard payment service user funds

- If you provide payment initiation services (PIS) and account information services (AIS) you must hold adequate professional indemnity insurance

- Directors and managers must be of good repute with appropriate skills to provide payment services

- Managers must not have been convicted of money laundering, terrorist financing or other financial crimes

- Your head office and registered office must be in the UK

- Your MLRO must be based in the UK

- You must comply with the Money Laundering, Terrorist Financing, and Transfer of Funds (Information on the Payer) Regulations

- Anyone having a qualifying holding must be fit and proper, and

- If the applicant has close links to another person, the links mustn’t be likely to prevent the FCA’s effective supervision of the business

What are the documents required for obtaining a payment institution license UK?

As part of a typical payment institution license UK application, the following information must be prepared and provided to the regulator:

- Company identification details;

- Program of operations;

- Business plan and financial forecasts;

- A description of your business’s organizational structure;

- Evidence of your initial capital;

- Measures to safeguard the funds of your users;

- Compliance & governance arrangements and internal controls;

- Procedure for monitoring, handling, and following up on security incidents and security-related customer complaints;

- Processes for filing, monitoring, tracking, and restricting access to sensitive payment data;

- Business continuity measures;

- The principles and definitions applicable to the collection of statistical data on performance, transaction, and fraud;

- Security policy;

- Internal control mechanisms to comply with obligations in relation to money laundering and terrorist financing (AML/CTF) obligations.

What is the procedure for obtaining a payment institution license UK?

The procedure to set up a payment institution may vary depending on the amendments taking place in the local laws and regulations. Tetra Consultants has summarized the most prevalent steps that take place during the normal engagement of attaining the payment institution license.

Step 1: Evaluating the optimum form of business structure and requirements of a payment institution license

- Tetra Consultants will advise you on the most appropriate form of entity and license for your business based on your projected business operation.

- Prior to the commencement of the engagement in the jurisdiction, our team of specialists will present you with the licensing requirements, including eligibility criteria, paid-up capital requirements, local economic substance requirements, timelines, and procedures.

Step 2: Conducting fit & proper test

- Tetra Consultants’ team of experts will make sure that every key managerial personnel engaged has the requisite qualifications and is competent enough to take the position, by verifying the informational data and supporting documents for the same.

Step 3: Company registration

- Tetra Consultants will perform due diligence on the company’s directors and shareholders. We will move to register the entity with the local Companies Registry after we have all KYC credentials, incorporation forms, and power of attorney.

- We will send the corporate documents, including the Certificate of Incorporation, Memorandum and Articles of Association, and other administrative documents, after the business has been properly registered.

Step 4: Preparation of documents

- The legal experts at Tetra Consultants will draft the necessary documentation for the licensing application. Depending on the other local laws, these papers will contain the company strategy, AML/CFT policy, and other necessary documents.

- Tetra Consultants will deliver you the draft of such documents after they have been prepared. Following that, we will email them to you for e-signature and start working on your license application.

Step 5: Meeting local economic substance requirements

- In the event the local regulator requires you to have economic substance, Tetra Consultants will assist you to meet them. Our team will assist with the recruitment of local qualified employees to join the team.

- Tetra Consultants HR team will conduct the shortlisting and initial interview with the candidates. Thereafter, you can shortlist the final list of candidates to determine who is most suitable to join the team. Once the candidate is chosen, Tetra Consultants will assist to prepare an employment contract with the terms and conditions that are agreed upon.

- Our team will also shortlist a list of physical offices and send them to you. We will include important considerations such as monthly rental, location, size, etc so you can better decide which is most suitable for you. Once the office is chosen, Tetra Consultants will prepare the lease agreement to be signed between you and the landlord.

Step 6: License application

- Once the above is completed, Tetra Consultants will submit the application to the local regulator. Depending on the jurisdictions, you may be required to attend an interview with the regulator prior to license approval. In this case, Tetra Consultants will prepare you for the interview and assist with the follow-up actions required by regulatory authorities.

- All going well, your firm will receive the payment institution license UK and will be required to start business operations within the stipulated timeframe in order to maintain the license.

Step 7: Opening a corporate bank account

- Tetra Consultants will proceed to open a corporate bank account with a reputable bank. This bank account will be used to deposit the minimum paid-up capital required to secure the license.

How long does it take to obtain a payment institution license UK?

Prior to the start of the engagement, Tetra Consultants will send you a project plan with the timelines stipulated for company registration, preparation of documents as well as license application. This is to ensure that all parties are clear on the upcoming project.

Our services

- The life cycle of any company with a non-bank payment license like a payment institution license UK depends significantly on how reliable was the foundation it is built upon. Some start-ups may survive and prosper, but most will not see the growth stage. To be one of the former, you must take all steps in a calculated manner. Such an approach will help you to achieve success and grow your business exponentially. Obtaining a payment institution license UK is a crucial step in establishing your fintech company, providing such payment services.

- Tetra Consultants will guide you through the whole process, prepare necessary documents, forms, and applications, and assist you in communication with the relevant authorities.

- Tetra Consultants will guide you through the whole process, prepare necessary documents, forms, and applications, and assist you in communication with the relevant authorities.

- Additionally, Tetra Consultants will manage and provide you with assistance for the development of a business plan, preparation of documents required for the payment institution license UK application (financial projections, policies & procedures, terms & conditions, authorization forms, etc), setting up a company, finding an office, the opening of a corporate bank account.

- Tetra Consultants will assist you with communications with the FCA and government officials throughout the whole course of the engagement.

- In addition, Tetra Consultants can also assist with attaining other offshore financial licenses depending on your long-term business goals.

Find out more!

Contact us to find out more about how to get a payment institution license UK. Our team of experts will revert within the next 24 hours.